Absorption costing means that ending inventory on the balance sheet is higher, while expenses on the income statement are lower. These are expenses related to the manufacturing facility, and they are considered fixed costs. Direct labor costs are the wages and benefits paid to employees who are directly involved in the production of a product. These are individuals whose efforts can be directly attributed to a specific product’s manufacturing. The key costs assigned to products under an absorption costing system are noted below.

Absorption Costing in Financial Reporting

A manager could falsely authorize excess production to create these extra profits, but it burdens the entity with potentially obsolete inventory, and also requires the investment of working capital in the extra inventory. Under rob stone, all manufacturing costs, both direct and indirect, are included in the cost of a product. Absorption costing is typically used for external reporting purposes, such as calculating the cost of goods sold for financial statements. Inventory valuation is a critical aspect of absorption costing, as it determines the cost of unsold inventory and cost of goods sold. Under this method, both fixed and variable manufacturing costs are included in the valuation of ending inventory on the balance sheet. Consequently, unsold inventory carries a portion of the fixed costs, which are not expensed in the income statement until the inventory is sold.

Step 1. Assign Costs to Cost Pools

- The deferral of tax payments can be advantageous for cash flow management, allowing businesses to utilize funds that would otherwise be paid in taxes for other operational needs or investments.

- This is because all fixed costs are not deducted from revenues unless all of the company’s manufactured products are sold.

- The direct correlation between production levels and variable costs also aids in cost control and management, as it becomes easier to monitor changes in costs in response to changes in production volume.

- It is easier to discern the differences in profits from producing one item over another by looking solely at the variable costs directly related to production.

- It also plays a critical role in inventory management, potentially affecting an organization’s financial health and operational strategies.

Absorbed overhead is manufacturing overhead that has been applied to products or other cost objects. Variable overhead costs directly relating to individual cost centers such as supervision and indirect materials. You need to allocate all of this variable overhead cost to the cost center that is directly involved. This is important for financial reporting and decision-making because it takes into account both variable and fixed production costs. Even if a company chooses to use variable costing for in-house accounting purposes, it still has to calculate absorption costing to file taxes and issue other official reports. The term “absorption costing” means that the company’s products absorb all the company’s costs.

Apportionment of Fixed Manufacturing Overhead

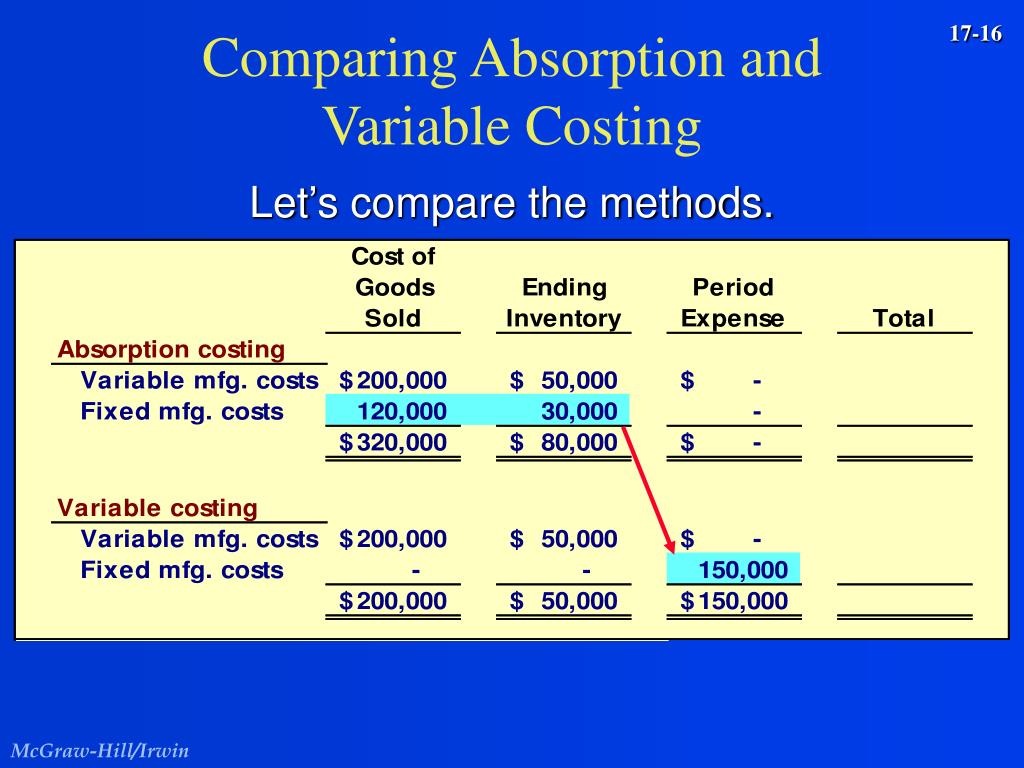

These ratios are often used by investors and creditors to assess the liquidity and operational efficiency of a business, making the choice of costing method a significant factor in financial analysis and decision-making. Absorption costing and variable costing are two different methods of costing that are used to calculate the cost of a product or service. While both methods are used to calculate the cost of a product, they differ in the types of costs that are included and the purposes for which they are used. The differences between absorption costing and variable costing lie in how fixed overhead costs are treated. Variable manufacturing overhead costs are indirect costs that fluctuate with changes in production levels.

What Not to Include in an Absorption Costing System

On the downside, things can get a little tricky when it comes to making an exact calculation of absorbed costs, and knowing how much of them to include. If all of the variables are not considered carefully (including depreciation, administrative expenses, and yearly fluctuations in your expenses), it can give you misleading results. Absorption costing is normally used in the production industry here it helps the company to calculate the cost of products so that they could better calculate the price as well as control the costs of products. General or common overhead costs like rent, heating, electricity are incurred as a whole item by the company are called Fixed Manufacturing Overhead. Maybe calculating the Production Overhead Cost is the most difficult part of the absorption costing method. The following is the step-by-step calculation and explanation of absorbed overhead in applying to Absorption Costing.

The following subsections delve into how absorption costing is utilized within these diverse business environments. Absorption costing is typically used in situations where a company wants to understand the full cost of producing a product or providing a service. This includes cases where a company is required to report its financial results to external stakeholders, such as shareholders or regulatory agencies. Suppose we have a fictional company called XYZ Manufacturing that produces a single product, Widget X.

Under absorption costing, companies treat all manufacturing costs, including both fixed and variable manufacturing costs, as product costs. Remember, total variable costs change proportionately with changes in total activity, while fixed costs do not change as activity levels change. These variable manufacturing costs are usually made up of direct materials, variable manufacturing overhead, and direct labor.

Indirect costs are typically allocated to products or services based on some measure of activity, such as the number of units produced or the number of direct labor hours required to produce the product. You can calculate a cost per unit by taking the total product costs / total units PRODUCED. Yes, you will calculate a fixed overhead cost per unit as well even though we know fixed costs do not change in total but they do change per unit.

This can be particularly useful for long-term pricing strategies and inventory management. Moreover, the method can provide a more stable basis for performance evaluation, as it avoids the potentially misleading cost fluctuations that can arise from only considering variable costs. However, the allocation of fixed costs can sometimes obscure the true cost behavior in response to changes in production volume, which is a consideration that management must take into account when making operational decisions. Absorption costing is linking all production costs to the cost unit to calculate a full cost per unit of inventories. This costing method treats all production costs as costs of the product regardless of fixed cost or variance cost.

Absorption costing also provides a company with a more accurate picture of profitability than variable costing, particularly if all of its products are not sold during the same accounting period as their manufacture. This is significant if a company ramps up production in advance of an anticipated seasonal increase in sales. In corporate lingo, “absorbed costs” often refer to a fixed amount of expenses a company has designated for manufacturing costs for a single brand, line, or product. Absorbed cost allocations for one product produced may be greater or lesser than another. This method of full absorption costing becomes very important is there is the need to follow the accounting principles for external reporting purposes. This not only helps the management in evaluation of the financial condition of the business but also estimate the cost and plan production accordingly.