NPV allows for easy comparison of various investment alternatives or projects, helping decision-makers identify the most attractive opportunities and allocate resources accordingly. The capital budgeting sums are the amounts of money involved in capital budgeting. Examples of capital budgeting include purchasing and installing a new machine tool in an engineering firm, and a proposed investment by the company in a new plant or equipment or increasing its inventories. It is estimated that each of the alternative projects will require an additional working capital of $2,000, which will be received back in full after the end of each project.

Steps to Calculate Net Present Value

Consequently, understanding and applying present value is deemed essential for anyone involved in investment decisions. If someone offers you 1000 dollars today or promises to give you 1050 dollars after a year, you may be tempted to wait and take the larger sum later. However, the present value of that 1050 dollars (depending on the discount rate) may be less than 1000 dollars. Understanding the role of present value in financial decision-making allows investors to assess profitability or the value of an investment more realistically. Essentially, present value serves as a tool in investment decision making because it allows investors to translate future dollars or other currencies into their present worth. Put another way, if you were given a choice between receiving a sum of money today or the same sum a year from now, the rational choice would be to opt for money now.

PV Calculation Examples

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site.

Compute the net present value of money with WolframAlpha

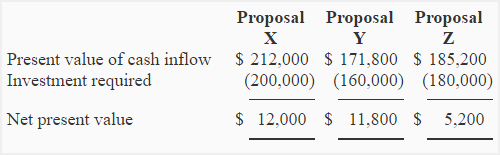

Let’s start with the simplest case, of estimating the Present Value of a single cash flow. The value of a company, or a stock, a business, etc, is all fundamentally based on the Present Value of future expectations. Let’s take a few examples to illustrate how the net present value method is employed to analyze investment proposals. If present value of cash inflow is less than present value of cash outflow, the net present value is said to be negative and the investment proposal is rejected. If present value of cash inflow is equal to present value of cash outflow, the net present value is said to be zero and the investment proposal is considered to be acceptable. The present value (PV) concept is fundamental to corporate finance and valuation.

All of our content is based on objective analysis, and the opinions are our own. Moreover, it is vital to recognize the differences between Present Value and Net Present Value, as each method serves a unique purpose in financial analysis. Individuals use PV to estimate the present value of future retirement income, such as Social Security benefits or pension payments. This information helps individuals determine how much they need to save and invest to achieve their desired retirement income. For the PV formula in Excel, if the interest rate and payment amount are based on different periods, then adjustments must be made. A popular change that’s needed to make the PV formula in Excel work is changing the annual interest rate to a period rate.

The discount rate is highly subjective because it’s simply the rate of return you might expect to receive if you invested today’s dollars for a period of time, which can only be estimated. Because it quantifies the value created per dollar invested, as opposed to simply looking at expected cash flows and investment costs. While NPV offers numerous benefits, it is essential to recognize its limitations, such as its dependence on accurate cash flow projections and sensitivity to discount rate changes. NPV is sensitive to changes in the discount rate, which can significantly impact the results. Small changes in the discount rate can lead to large variations in NPV, making it challenging to determine the optimal investment or project. It involves assessing the potential projects at hand and budgeting their projected cash flows.

- Projects that require large investments typically have tighter profit margins, which may result in lower PVI results.

- Understanding the role of present value in financial decision-making allows investors to assess profitability or the value of an investment more realistically.

- Stocks are also often priced based on the present value of their future profits or dividend streams using discounted cash flow (DCF) analysis.

- This assumption might not always be appropriate due to changing economic conditions.

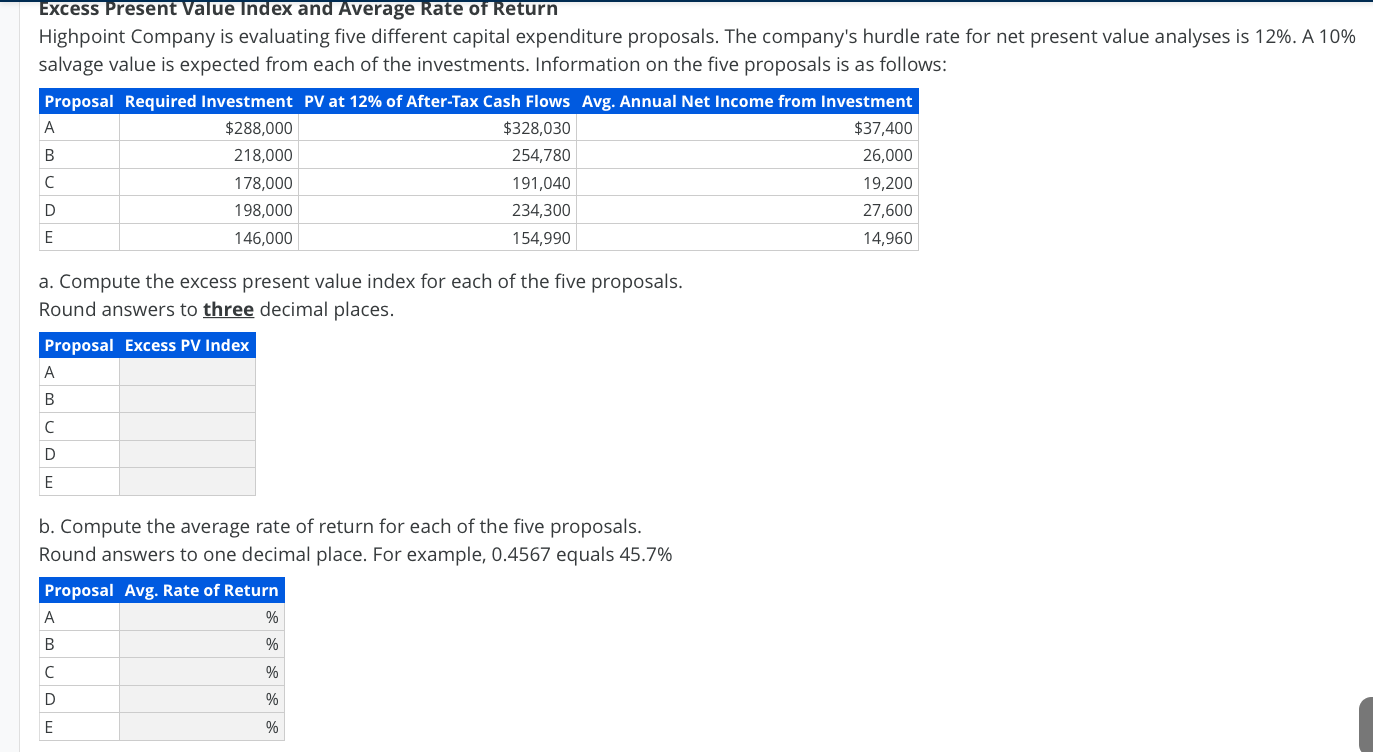

I’m happy to be able to spend my free time writing and explaining financial concepts to you. Some analysts calculate the PVI by dividing the NPV by the initial investment. But the initial investment is already subtracted from the NPV, so this works as a sort of return on investment in percentage terms. The capital budgeting numericals are the various types of numbers used in applying different capital budgeting techniques.

In the realm of capital budgeting, present value is a critical component that aids in investment decision-making. It is a tool that assists in comparing the value of money today and in the future, thereby helping organizations to prioritize and decide on long-term investment projects. This process of discounting future cash flows helps in determining whether the expected return on investment would exceed the initial outlay. Therefore, the higher the present value of future cash flows, the more likely an investment is to be considered profitable. PV is a significant concept in finance, as it helps individuals and businesses to make investment decisions by estimating the current value of future cash flows. By calculating the PV of potential investments, investors can determine if an investment is worth pursuing or if they would be better off pursuing alternative investment opportunities.

Starting off, the cash flow in Year 1 is $1,000, and the growth rate assumptions are shown below, along with the forecasted amounts. Conversely, lower levels of risk the super bowl and uncertainty lead to lower discount rates and higher present values. Of course, both calculations also hinge on whether the rate of return you chose is accurate.